what is the tax rate in tulsa ok

The Tulsa Sales Tax is collected by the merchant on all qualifying sales made within Tulsa. The average cumulative sales tax rate between all of them is 828.

2021 Tulsa County Tax Rates.

. The Oklahoma income tax has six tax brackets with a maximum marginal income tax of 500 as of 2022. Tulsa County collects a 0367 local sales tax less than the 2 max local. This is largely a budgetary exercise with unit managers first budgeting for yearly expenditures expectations.

2 to general fund. The most populous location in Tulsa County Oklahoma is Tulsa. Of the seventy-seven counties.

Tulsa County collects the highest property tax in Oklahoma levying an average of 134400 106 of median home value yearly in property taxes while Cimarron County has the lowest property tax in the state collecting an average tax of 24400 043 of median home value per year. Tax rates sometimes referred to as millage rates are set by the Excise Board. Who is exempt from the tax.

4 rows Lower sales tax than 69 of Oklahoma localities. Has impacted many state nexus laws and sales tax collection requirements. The Tulsa County sales tax rate is.

It isnt all good news for Oklahoma taxpayers however. The total sales tax rate in any given location can be broken down into state county city and. The tax must be paid on the occupancy or the right of occupancy of rooms in a hotel.

State of Oklahoma - 45. Other installers track salary. The Tulsa Sales Tax is collected by the merchant on all qualifying sales made within Tulsa.

The Sooner States property taxes are also below average with an average effective rate of 087 25th-lowest in the US. The Tulsa County Sales Tax is collected by the merchant on all qualifying sales made within Tulsa County. The City has five major tax categories and collectively they provide 52 of the projected revenue.

The City of Tulsa imposes a lodging tax of 5 percent. The Oklahoma state sales tax rate is currently. 2483 lower than the maximum sales tax in.

While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does not currently collect a local sales tax. The December 2020 total local sales tax rate was also 4867. County of Tulsa 2021 Levies Detail.

To compare Tulsa County with property tax rates in other states see our map of property. That puts Oklahomas top income tax rate in the bottom half of all states. After this its a matter of determining what combined tax rate is.

Sales tax at 365. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. What is the lodging tax rate.

The Tulsa County Oklahoma sales tax is 487 consisting of 450 Oklahoma state sales tax and 037 Tulsa County local sales taxesThe local sales tax consists of a 037 county sales tax. As far as all cities towns and locations go the place with the highest sales tax rate is Glenpool and the place with the lowest sales tax rate is Leonard. The current total local sales tax rate in Tulsa County OK is 4867.

The average total salary of Installers in Tulsa Metro Area OK is 41500year based on 29 tax returns from TurboTax customers who reported their occupation as installers in Tulsa Metro Area OK. A permanent resident One who occupies or has the right to occupy any room or rooms in the hotel for at least 30 consecutive days. The 2018 United States Supreme Court decision in South Dakota v.

When added together the property tax burden all taxpayers bear is established. Earn what you deserve. 4 rows Sales Tax Breakdown.

This is the total of state and county sales tax rates. Download all Oklahoma sales tax rates by zip code. The most populous zip code in Tulsa County Oklahoma is 74012.

The median property tax also known as real estate tax in Tulsa County is based on a median home value of and a median effective property tax rate of 106 of property value. The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a 037 county sales tax and a 365 city sales tax. Detailed Oklahoma state income tax rates and brackets are available on this page.

Tulsa County - 0367. For the 2021 tax year Oklahomas top income tax rate is 5. Taxes are based upon budgets submitted by taxing jurisdictions and include the amounts necessary to pay bonded indebtedness approved by a vote of the people.

With a total assessed taxable market value established a citys budget office can now determine appropriate tax rates. Norman OK Sales Tax Rate. The minimum combined 2022 sales tax rate for Tulsa County Oklahoma is.

29 full-time salaries from 2019. Effective Tax Rates for Installers in Tulsa Metro Area OK. Mustang OK Sales Tax Rate.

The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. Whether you are already a resident just considering taking up residence in Tulsa or interested in investing in its real estate find out how city property taxes. Tulsa County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections.

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Pros And Cons Of Living In Tulsa Ok Securcare Self Storage Blog

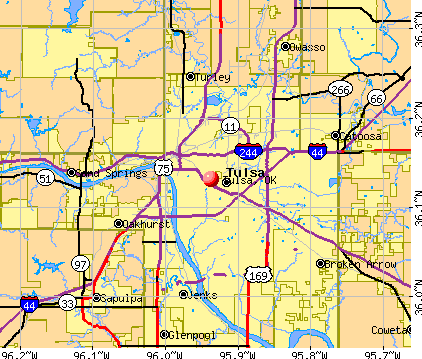

Tulsa County Oklahoma Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

The Best Places To Own A Home And Pay Less In Taxes The Good Place Estate Tax Tax

Winter Storm Watch Issued For Most Of Northeast Oklahoma

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Timeline How The Tulsa Medical Office Mass Shooting Unfolded Abc News

Here There Tulsa Oklahoma Decatur Magazine

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Pros And Cons Of Living In Tulsa Ok Securcare Self Storage Blog

Tulsa Oklahoma Will Pay You 10 000 To Move There And Work From Home

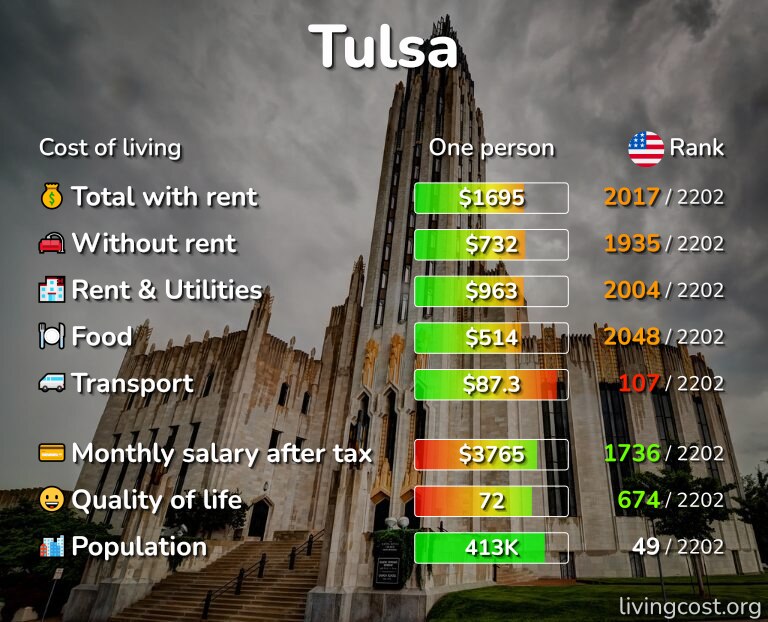

Tulsa Ok Cost Of Living Salaries Prices For Rent Food

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Tulsa County Oklahoma Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Tulsa Oklahoma City Among Forbes List Of Most Dangerous Cities

Tulsa County Oklahoma Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More